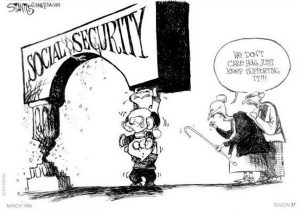

Our Social Security system is widely known as the “third rail” of American politics (“you touch it and you die”). Indeed, President Trump promised not to touch it, saying that when America “becomes rich again” “Social Security can be afforded” and that we need to “get rid of the waste” and “get rid of the fraud”. President Trump defeated numerous other Republican candidates who had pledged to raise the retirement age, privatize Social Security, and/or balance the system through a combination of raising caps on payroll taxes with adjustments to benefits.

However, even if we were to become, in the next 50 years or so, a much wealthier nation, with no government waste and no fraud, it would not solve the basic mathematical problem of Social Security. People continue to live longer (and, hopefully, in the richer nation with better health care that President Trump envisions we will live ever longer). The post-war baby boom is over, and the boomers are retiring. So there isn’t enough money from payroll taxes coming into the system to support the payments to those long-living retirees. This is why President George W Bush in 2004 said the Social Security system was “headed toward bankruptcy”. Many object to the term “bankruptcy” because there is no such thing for Social Security, but the date at which the Social Security system is currently projected to fall short of the funds needed to pay full benefits to retirees is 2034. In 2004, when George W Bush treated it as an emergency, that was 30 years away. In 2018, it is only 16 years away, and even as we become more prosperous that date is only coming nearer. There are very few who believe that waiting will make the problem easier to solve.

Yet we do nothing, because we cannot agree on how to fix the imbalance and, as President Trump has observed, there are no political rewards for changing the system — only political penalties.

George W Bush’s proposed “fix” was a partial privatization of Social Security, keeping the system essentially fixed for older workers and retirees, while giving younger workers investment options for their contributions in order to allow them to grow at a faster rate (and thereby cover the projected shortfall through the compounding of higher investment returns). Some politicians still favor partial privatization. However, Jeb Bush, the former president’s brother, was not among them in 2016, because he said it was too late for that option — that some combination of increasing revenues (such as by raising the caps on payroll contributions) with benefit cuts (such as increasing the full retirement age) would be necessary.

It is extremely difficult to make a practical, principled or mathematical argument against changing the Social Security formulas, and especially to make an argument against raising the Social Security retirement ages. In 1983, Congress passed legislation to raise the retirement age by two years (from 65 to 67) gradually over a 22-year period for those born in 1938 or later. In the 35 years since then, the life expectancy at age 65 has increased by about 3 years. It has increased by a greater amount among men, who at least during those years were more likely to be contributing workers, and those who are the most wealthy are most apt to live longer. Therefore, the system is paying out more now in benefits to retirees at a given relative contribution level than it was before, simply because they are living longer, and a disproportionate share of those benefits goes to those who are already well off. This is not to say that there aren’t a lot of retirees who depend on Social Security and aren’t well off!

The “third rail” argument against raising the retirement age is that it would reduce benefits for older people. Older people vote more than younger people; they have a powerful lobby, and they have the sympathy of many of us who are their children and grandchildren. So, even though raising the retirement age (and other related modifications, such as reducing payouts or increasing taxes on very wealthy retirees and/or changing the annual cost of living adjustment formula) make sense, they don’t happen because of politics.

My mother is 85, healthy, and well off. She doesn’t need Social Security; she would live just fine without it. Perhaps not surprisingly, she is violently opposed to any changes in her benefits; in fact, she thinks they are inadequate. She feels that she is entitled to them. Of course, she is entitled, but she doesn’t need them, and the future healthy, wealthy, entitled 85 year olds may just have to settle for less than they were expecting.

My 85-year-old mother is quick to point out many other problems with Social Security. For example, she feels that the program discriminates against women, in the following way: when Social Security started, more retirees were married, most of the men in couples were somewhat older than their spouses (and women lived longer), and the men typically made quite a bit more money; in fact, usually the women were homemakers and didn’t contribute to the Social Security system much at all. So Social Security provides a “surviving spouse” benefit that gives the surviving spouse if his/her partner dies the choice at retirement of getting the deceased partners benefit or their own Social Security benefit, that is, whichever is greater, but not both. To my mother, this means in her mind that she had to forfeit all of her hard-earned contributions to the program, since my Dad had made more money and he died young. She worked as a public school teacher for virtually her entire career, and she doesn’t think it’s fair that she shouldn’t get any of her benefit because she’s using Dad’s as the surviving spouse. I think she’s got a point, just like the people who say they shouldn’t be paying for anyone else’s benefit have a point. It’s an entitlement program. Some people are going to end up being treated well, others may feel that they’re not getting their fair share, and the program designers have to make it work as fairly as possible. I don’t think my Mom should be getting two benefits, even though she think she’s entitled to more since she and Dad both paid in.

Left-leaning Democrats, who are opposed to cutting benefits in social programs in general, tend to argue against any benefit modifications and tend to favor balancing out the formulas by raising payroll tax rates and/or raising the salary caps beyond which no Social Security is withheld at all ($128,400 in 2018). Social Security can be thought of as a regressive system because on a percentage basis a worker who earns $128,400 in a year pays a higher percentage of their wages in Social Security than a worker who earns $1,284,000 in a year (the lower-paid worker pays 6.2%, while the millionaire pays 0.62%). The projected shortfall could be overcome, in whole or in part, by simply having the highly-paid workers contribute more.

While the math of making higher-paid workers pay a little more may seem to make sense, right-leaning Republicans and others aligned with them oppose raising the cap for a number of reasons. Conservative Republicans tend to oppose any tax increase, and can seem especially defensive when Democrats want to “soak the rich”. Also, you can make an argument that it’s unfair, since there are caps in benefits, to tax the higher-paid workers. They would be paying to support other workers, not for benefits to themselves, and the idea of Social Security was that it wasn’t supposed to be a tax; it was in theory a benefit program where you were putting in for your own benefit, more like insurance. Of course, insurance programs also famously make do by having low-risk people effectively pay for people who are higher risk. In any case, raising payroll taxes and/or raising payroll tax caps get vigorous political resistance from the anti-tax crowd.

So we do nothing. Even if President Trump succeeds at his promise to make us all rich, we will be worse off for doing nothing, as far as Social Security is concerned, or at least the younger people, our children and grandchildren, will be worse off. Perhaps it is their just reward since so many of them don’t vote. But most of us agree we still shouldn’t leave them with such a problem, where their benefits have to be reduced because there isn’t enough money to pay the benefits. It’s just a question of how to fix the system. As a practical matter, it’s going to have to be through a small amount of pain that’s distributed among a large group of people, combining adjustments to benefits with adjustments to contributions. That is the only sensible way.

What should we do as voters? Reward politicians with the courage to want to fix Social Security, and those who are willing to compromise. Do not reward political insults and accusations of “soaking the rich” or “throwing Grandma from the train”. Do not reward empty promises that the system will fix itself: Only real math can fix it. Ask hard questions, review the answers carefully, and vote.